The aviation industry is playing a key role in the Saudi Vison 2030. Boeing in its “Current Market Outlook 2017-2036” forecasts that airlines in the Middle East region will add substantial capacity to the market as it expects to make 3,350 deliveries aircraft to airlines in the Middle East in the next 20 years. The SAG reaffirmed in December 2017 its investment plans for 2018 and announced that it will raise total spending to USD 293 million on aviation. That investment is expected to generate revenue of USD 77 billion dollars in the 2018 budget.

Over the last two decades, the aviation market in Saudi Arabia has grown substantially. Following a noticeable growth acceleration over the past five years, the Kingdom’s airports in 2017 handled more than 91.8 million passengers. Saudi Arabia’s population is heavily concentrated in a few large cities, and the concentration of traffic among airports shows a similar pattern. The top four airports, namely Jeddah, Riyadh, Dammam, and Madinah, presently account for more than 80 percent of the passenger traffic.

Several favorable factors have contributed to the dynamic growth of the Saudi market including Domestic Fare Cap as General Authority of Civil Aviation of Saudi Arabia (GACA) took positive steps toward reforming the domestic fare cap in 2015 when it allowed domestic carriers to lift ticket prices within 10 days of departure. More recently, consensus rests on less regulatory intervention and the phasing out of price controls, so airlines have far more flexibility and freedom in how they set prices based on market drivers.

There are currently 28 airports in the Kingdom, six are international, nine are regional and 13 are domestic. Three of its airports are amongst the busiest in the GCC, transporting the bulk of the 82 million passengers who pass through the Kingdom on a yearly basis. KSA connects to 81 airports in 45 countries, allowing for more than 1.2 million tons of cargo to be shuttled around the globe. Approximately 90 percent of the Saudi population lives within a two-hour drive of the nearest airport, making air travel a popular transport option. To improve the infrastructure of airport facilities, the SAG has approved an expansion plan which contemplates both the upgrade of the existing airports and the construction of new airports. The planned expansion includes the redevelopment of the airports in Abha, Al Ahsa, Al Qassim, Arar, Hail and Jizan. There are also plans to develop new airports in Al-Qunfudah, Farasan Island and Taif, Riyadh North and Riyadh South. Also, plans are being formulated by GACA to assess the feasibility of a new airport in the Mecca province, which would be business-based as opposed to the new Taif Airport whose primary objective is to serve the profitable religious traffic segment.

GACA has announced to privatize all its 28 airports by 2020 to raise revenues, encourage best in class international operators, manage the passenger travel chain, and seek private sector investments to fund capital expansion plans. This will include the transfer of GACA’s air navigation and IT functions to the private sector. Each airport will be transformed into an operating company with its own board responsible for all operational and financial performance. GACA’s privatization strategy aims to transfer all Saudi airports to companies wholly owned by the Saudi Civil Aviation Holding Co., then transfer ownership of the holding company to the Public Investment Fund (PIF).

The process is underway with GACA envisaging three different models as exemplified by airport developments in Riyadh, Dammam, Jeddah and Medina. The first relates to the transfer of an airport to a company, like what is happening at King Khaled International Airport in Riyadh (Riyadh Airport Company (RAC), where a minority holding is sold to private investors. Then an airport board of directors is formed that has powers in the management of the company. The second method is operation and maintenance, like what happened at the new King Abdul Aziz International Airport in Jeddah with Changi before cancellation of the contract earlier this year. GACA will bear the capital cost of establishing the project and will share the income with investors. A new announcement to operate and maintain the airport is expected to be issued in the second half of 2018 and foreign companies can bid directly. The third method is the BTO (build, transfer and operate) system, such as what was done with Prince Mohammed bin Abdul Aziz Airport in Madinah, and with Taif, Hail, Qassim and Yanbu airports. GACA will be the regulator and controller of the aviation sector in the next phase, in the event of concluding the privatization process.

To achieve its strategy, GACA has created several state-owned companies during the years 2016-2018 to foster the aviation business in Saudi Arabia such as Riyadh Airport Company (RAC), Saudi Aviation Information Technology Company (SAVIT), Saudi Air Navigation Services (SANS) and Dammam Airport Company (DACO).

King Khalid International Airport in Riyadh, meanwhile, opened its new, multibillion-dollar Terminal 5 a couple of years ago. The expansion is the first privately run terminal in Saudi Arabia, managed and operated by the Dublin Airports Corporation. King Khalid International Airport was the first asset to be privatized based on a master plan developed by the Kingdom. On 2016, Swissport, meanwhile, won the second license to offer ground services across the Kingdom’s airports. Similarly, SATS, Singapore’s biggest ground handler, will develop and operate a new cargo terminal at King Fahd International Airport (KFIA) in Dammam.

Work is also under way to open commercial real estate investment in airport properties—based on the “airport city” model—to global competition, and to privatize the Prince Sultan Academy for Aviation Sciences. There is also work under way to privatize the Saudia Private Aviation Company, Saudia Real Estate Development Co. Ltd., and Saudia Medical Services Co. Ltd.

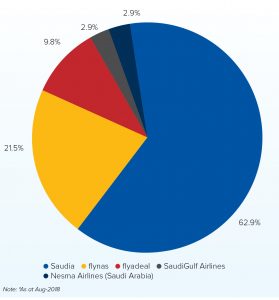

Saudi Arabian Airlines (also known as Saudia) is the national carrier and main commercial airline in the country. Saudia has a fleet of almost 119 aircraft operating on 89 routes, including 62 international destinations across four continents. The airline has been renovating its fleet in recent years and has announced plans to increase the number of aircraft to 200 and routes by 2020. The second largest airline in the Kingdom is Flynas, a low- cost carrier founded in 2007. The airline has a fleet of 31 aircraft. It is also expanding. Nesma Airlines has a total fleet of 10 aircraft and operates within the Kingdom of Saudi Arabia. SaudiGulf has a fleet of four aircraft and it has announced plans to expand internationally. Flyadeal, the low- cost subsidiary of Saudia which started operations in September 2017, has already announced that it expects to have a fleet of eight aircraft by mid-2018 and has plans for ordering 50 new aircraft soon.

Links :

Dubai Airshow : www.dubaiairshow.aero

Saudi Airshow : www.saudiairshow.aero

Saudi Aerospace Engineering Industries : www.saei.aero