The Saudi power sector is on a steep growth trajectory and racing to keep up with significantly increasing electricity demand. Domestic consumption rose at an unprecedented yearly rate of seven percent through 2017. Due to heavily subsidized domestic oil prices, Saudi Arabia currently relies on liquid petroleum for approximately 60 percent of its electricity generation. As a result, yearly increases in electricity demand are cutting directly into the country’s oil export volume and export earnings. To reduce consumption of oil in power generation, Saudi Arabia is eager to upgrade its entire power sector. Apart from increasing its non-oil generation capacity, it is looking to replace its outdated transmission and distribution infrastructure (T&D), implement smart grid technology, and promote international grid connectivity.

Saudi Arabia faces a daunting task in expanding its power generation. It is estimated that the Kingdom needs to increase power generation capacity from 82GW in 2017 to 160GW in 2040 – more than doubling its generated supply. This translates into installing 5GW of capacity and T&D infrastructure per annum through 2020. To achieve generation targets, the government is looking to make a yearly investment of approximately USD 5 billion in generation and USD 4 billion in T&D. Moreover, Saudi Arabia intends to privatize all electricity generation by 2025. The newly-to-be privatized power generation companies are expected to need substantial investment to increase efficiency, provide fuel substitution (replacement), meet environmental standards, and replace aging power plants.

The major power sector entities in Saudi Arabia are:

- Ministry of Energy, Industry, and Mineral Resources (MEIM) is the government agency that handles policy and planning in the power sector.

- Saudi Electricity Company (SEC) is a government-owned (PIF) entity (over 80 percent of shares) that currently provides most of Saudi Arabia’s electricity, with a generation capacity of 74GW in 2017. It also carries out all transmission and

- Saline Water Conversion Corporation (SWCC) is the government agency that operates desalination and associated power pants.

- Water & Electricity Co. (WEC) is a government-owned company that acts as an off-taker with a clear mandate to facilitate private sector participation in independent water and power projects (IWPP).

- Saudi Aramco is the government-owned company that manages Saudi Arabia’s oil and gas production. It is involved in power generation alongside SEC.

- Electricity and Co-Generation Regulatory Authority (ECRA) is the Kingdom’s independent regulatory body for Saudi Arabia’s energy

- King Abdullah Center for Atomic and Renewable Energy (KACARE) was established by royal decree in 2010. It focuses mainly on nuclear energy and technology localization in the burgeoning renewable energy

- Power and Water Utility Company (MARAFIQ) is a government-owned entity that currently provides most of the power to the two industrial cities of Jubail and Yanbu, found in the Eastern province and the Al-Madinah Province, respectively.

Leading Sub-Sectors Nuclear Energy

In November 2017, the Saudi Arabian government announced plans to construct two large nuclear power reactors. This latest effort has been scaled back from building 15 reactors over the next 20-25 years at a cost of more than USD 80 billion. The original projections included 17 GW of nuclear capacity by 2040 to provide 15 percent of the power generated in Saudi Arabia. Plans for small reactors for desalination are well advanced on two fronts.

Power Distribution and Grid

Some segments of Saudi Arabia’s current grid are outdated and inefficient. There is a plan to replace old substations, transformers, and other infrastructure to reduce energy wastage. MEIM expects most of this improvement to take place between 2016 and 2020, with operations continuing to 2023. Additionally, there is a plan to link the Central and Western regions, with USD 4 billion to be invested in distribution projects annually.

The Kingdom of Saudi Arabia maintains 16 percent of global electricity generation and is the 12th largest consumer of generated electricity. The main feed stocks are crude oil and natural gas. The country is planning to work towards greater efficiency and diversification of electricity generation, including alternative and renewable energy. At the same time, grid modernization and better connectivity should ensure that the Kingdom is able to meet peak demand always. Given the growth and diversification of the Saudi economy and the country’s desire to diversify the power mix, the Kingdom of Saudi Arabia continues to be the most important market for electricity generation technology and equipment in the Middle East. “Made in the USA” technologies are highly respected and sought after, offering promising opportunities for U.S. companies.

Alternative Energy

In its 2015 strategic plan, MEIM announced its plan to move away from oil feed stock and add more natural gas and renewable energy sources to its energy mix. In 2017, the MEIM formed the Renewable Energy Project Development Office (REPDO) with responsibility for contracting/tendering for

- GW of PV solar and wind by 2023, with the intermediate goal of 3.45 GW by 2020. As renewable energy comes online, there will be increased demand for integration technology onto the national grid. This will include energy storage capability for better power quality, reliability, and balancing any inconsistencies from renewables. Saudi Arabia and SoftBank Group Corp. in March 2018 signed a memorandum of understanding to build a USD 200 billion solar power development that’s several times larger than any other project. At 200 GW, the SoftBank project planned for Saudi Arabia by 2030 would be largest in the

Smart Grid/Transmission & Distribution

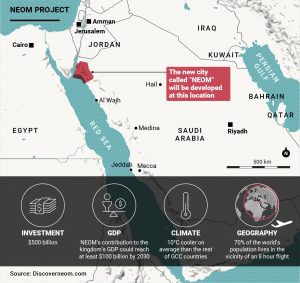

To better equip its grid system for peak power demand, the Kingdom of Saudi Arabia recently led a Gulf Cooperation Council project to link the electricity grids of the member states. This has introduced the region to international power trading. Moreover, the Kingdom is looking to build a 3 GW link with Egypt, estimated at USD 1.6 billion. This will off-set peak loads from each country as well as provide the back bone to the new NEOM project. The link to Egypt will be part of the north-south grid back up using a strong DC inter-connection. This includes a high voltage DC link to strengthen the reliability and sustainability of the networks. Links with Jordan, Turkey, Yemen, and the entire Arab region have also been discussed. Due to dissimilar peak load times, these links would be well-suited to trading electricity, and improving the efficiency of each country’s grid.

In further pursuit of efficiency, the Kingdom is investing billions USD to install smart meter technology. SEC has been funding various projects to install 12 million smart meters by 2025 – replacing all the old meters in the country. By communicating energy consumption instantly via the internet, smart meters will allow the Kingdom to better manage its electricity usage. Installing such technology will facilitate the future integration of variable power sources like solar and wind, whose output is more erratic than that of traditional hydrocarbon plants.

Energy Efficiency

Energy subsidies cost the Saudi Arabian government over USD 70 billion in 2015. The government aims to eliminate energy subsidies by 2020, entailing higher electricity costs for consumers. These higher costs are expected to result in fast-growing demand for technologies, services, and products related to energy efficiency. The government has formed an energy service company (a “Super ESCO”) to implement projects in public facilities and support capacity building and project development activities of new private-sector ESCOs.

Opportunities

The following technologies offer continuing opportunities for exporters: smart meters, smart grid, alternative energy sources following grid upgrades, energy efficiency systems, and geospatial information technology and big data management.

Web Resources

Ministry of Energy Industry, and Mineral Resources

Renewable Energy Project Development Office

Saudi Electricity Company (SEC)

Saline Water Conversion Corporation

Water & Electricity Company (WEC)

Electricity & Co-Generation Regulatory Authority