Healthcare remains a top priority for the Saudi Arabian government (SAG). In 2018 the government allocated USD 39.2 billion for the Healthcare and Social Development sector, more than 10 percent over the 2017 figure. More than 22 percent of that budget will be spent on the initiatives of Saudi Vision 2030. The healthcare budget also stipulates the construction of 36 new hospitals (8,950 beds), two medical cities (2,350 beds) are expected to be completed by the end of 2018. The Ministry is expected to build an additional 18 hospitals with a bed capacity of 9,904 over the next two years.

In line with the government Vision 2030 and the 2020 National Transformation Plan (NTP), the Ministry of Health is expected to spend close to USD 71 billion over a five-year period ending in 2020. Among the objectives of the NTP for the healthcare sector in 2020 are:

• To expand the role of the private sector from 25 to 35 percent of total healthcare expenditures;

• To increase the number of licensed medical facilities from 40 to 100;

• To increase the number of internationally accredited hospitals;

• To double the number of primary healthcare visits per capita from two to four;

• To decrease the percentage of smoking and obesity by two percent and one percent from baseline respectively;

• To double the percentage of patients receiving healthcare after critical care and long-term hospitalization within four weeks from 25 to 50 percent

• To focus on improving the quality of preventive and therapeutic healthcare services; and,

• To increase the focus on digital healthcare innovations.

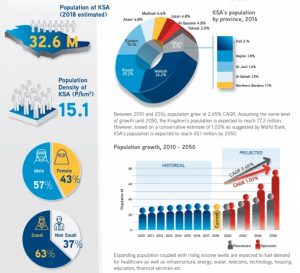

According to U.S.-based consultancy Aon Hewitt, the healthcare sector is expected to grow at a compound annual growth rate of 12.3 percent by 2020, reaching the value of USD 71.2 billion. This growth is fueled by urban expansion, especially in Makkah, Riyadh and the Eastern province. Saudi Arabia, like other countries in the Arabian Gulf, continues to exhibit negative lifestyle trends which are affecting morbidity statistics. Non-communicable diseases such as diabetes, cardiovascular disease and cancer have become the main causes of death among Saudis; their incidence is rising due to a sedentary lifestyle, obesity, high tobacco use, and poor dietary choices.

According to the International Diabetes Federation, Saudi Arabia has an 18.5 percent prevalence rate, with 3.85 million cases of diabetic adults in 2017. The British medical journal, the Lancet, has placed Saudi Arabia in third position worldwide in terms of obesity, and the latest figures from the medical community indicated that Saudi Arabia has one of the highest percentage of bariatric procedures including sleeve gastrectomy, gastric bypass, and the placement of gastric band.

Best Prospects include:

• Education and training services for physicians, nurses and technical staff;

• Information technology and data management services related to the digitization of patient records and billing information;

• Hospital management and joint ventures with Saudi partners;

• Investment in pharmaceutical manufacturing facilities for vaccines, sterile injectables, plasma, generics and other pharmaceuticals;

• Provision of support services and investments to establish local capabilities in bioequivalence centers, cold chain logistics, outpatient imaging and contract research organization (CROs);

• Provision of health insurance;

• Home healthcare, rehabilitation, and long-term care;

• Laboratories; and

• Primary healthcare and medical cities.

The Health Ministers’ of the Gulf Cooperation Council States releases annual tender worth billions of dollars for the following products and services: renal dialysis supplies; oral and dental care; laboratory supplies; orthopedic and spinal surgery supplies; rehabilitation equipment; cardiovascular devices; linens and medical uniforms; ophthalmology supplies; ENT supplies; medicines; vaccines; chemicals; insecticides; and radio- pharmaceuticals.

Leading Sub-Sectors

• Healthcare Services

• Medical Devices

• Pharma and biosciences

• Dental Services

Opportunities

Based on a latest study by Oxford Economics, Saudi Arabia’s population segment between the ages of 40 and 59 is expected to increase by 50 percent by 2035, which, in turn, will dictate a shift in the provision of healthcare services. That shift will be felt more in providing care for non- communicable diseases, including cardiovascular, diabetes, and obesity. More of the population will also have reached the age of 60, and the demand for geriatric care and home healthcare is also expected to expand. Those demographic changes also complement a rising demand for insurance coverage, which will be mandatory across the board under a Unified health insurance policy being planned by the Cooperative Council of Health Insurance (CCHI).

Privatization is expected to be a key focus area for the Saudi government. Among the immediate strategic objectives set forth in the NTP include:

• Privatization of a medical city through a PPP scheme;

• Increase the private sector share of spending in healthcare through alternative financing methods and service providers;

• Update and expand primary care;

• Provide additional rehabilitation and long-term care beds;

• Establish additional medical cities;

• Privatize King Faisal Specialist Hospital & Research Center; and

• Update and expand laboratory and radiology services.

The Ministry of Health has released a tender for the development of Health Clusters responsible for the provision of healthcare services in the Eastern Region. This pilot project covers approximately 2.9 million citizens in the Eastern Province of the Kingdom of Saudi Arabia—an area currently served by 35 hospitals and 250 primary health care (PHC) centers, in addition to specialty providers.

Saudi government Web links:

Saudi Food and Drug Administration

General Investment Authority

Saudi Commission for Health Specialties

Saudi Association of Public Health

Council of Cooperative Health Council

Events:

Global Health Exhibition, September 10-12, 2019, Riyadh, Saudi Arabia

Arab Health, January 28 – 31, 2019, Dubai, UAE