The Saudi 2030 Vision is based upon growing inward investment to stimulate and diversify the economy and transform the Kingdom of Saudi Arabia into a global hub connecting Asia, Europe and Africa as it enjoys a geographical competitive advantage with its accessibility to major emerging markets and important marine passages. The transportation and logistics sector in Saudi Arabia is a large and dynamic industry, strongly supported by state led investment in rail, maritime, road, logistics and airport infrastructure. Economic growth, population maturation and rapid urbanization are all factors driving Saudi Arabia to invest in the massive expansion of its transportation networks. This includes the introduction of urban transport systems such as metros and buses, as well as inter-urban networks such as freight and high-speed railways.

The Saudi Arabian government (SAG) is fully committed to developing the sector and has set aside considerable capital for expansion plans. The SAG 2018 budget includes an 86 percent increase in planned government expenditure on infrastructure and transportation, increasing from USD 7.7 billion to USD 14.4 billion. Between 2016 and 2020, Saudi Arabia plans to spend USD 53.3 million on improving railway cargo capacity and an additional USD 8 million on upgrading the rail network. The Ministry of Transport has been allocated USD 46.4 million to improve the efficiency of ports, specifically targeting a reduction in the time that containers are tied up in port customs (from 14 to five days).

Saudi Arabia is determined to broaden the role of the private sector as it pushes to diversify its economy. Private entities are being encouraged to collaborate with the government as it develops the Kingdom’s transport infrastructure. Partnership is being sought for the operation of seaports, airports and their related supply chains. Public-private partnerships (PPP) are being pursued to fund several key schemes, while a number of the country’s publicly operated transportation facilities are being readied for full privatization. Under the Saudi Foreign Investment Law, foreign investors can own 100 percent of businesses after obtaining a license from the Saudi Arabian General Investment Authority (SAGIA) and can bid in PPP projects directly or through a local consortium. A draft law covering partnership between the government and the private sector is under discussion to attract fresh foreign investments. By 2020, the target is for private sector companies to be involved in the development and operation of at least five percent of roads, 50 percent of the rail network and 70 percent of Saudi Arabia’s ports.

Logistics

A key pillar of the Saudi Vision 2030 is transforming the Kingdom into the go-to logistics hub for the region, capable of efficiently linking trade across three continents, Asia, Europe, and Africa. This strategic location provides the Kingdom with a unique advantage over other nations, enabling it to become a leading regional logistics hub.

Saudi Arabia’s logistics market is valued at USD 18 billion, making it the largest among the GCC nations. It accounts for 55 percent of the total GCC logistics market and is ranked third-most attractive within emerging markets. It is also one of the fastest growing logistics sectors globally and is expected to reach almost USD25 billion by 2020. The KSA logistics infrastructure is also well-established and is positioned to flourish with the largest maritime network in the Middle East, one of the largest road networks in the world and a new state of the art industrial city hub system about to open its doors.

The government aims to raise Saudi global ranking in the Logistics Performance Index from 49 to 25 and to increase its capacity to welcome Umrah and Hajj visitors from 8 million to 30 million every year. Import and export processes are being streamlined. Governance structures and regulations are being reformed, opening a path toward market liberalization and private-sector participation. In addition, public-private partnerships are helping finance the infrastructure and bringing in capabilities from the top logistics markets. By 2030, Saudi Arabia expects to be among the foremost logistics hubs in the region.

KSA has managed to reduce the time, cost and variability of importing goods through process re-engineering and automation. Average declaration clearance time at seaports has been cut in half to just 2.2 days and at airports to just 1.2 days, and the amount of import-export paperwork to fill out is down by 75 percent. The predictability and reliability of the clearance process has also significantly improved, with 40 percent of customs declarations in seaports now cleared within 24 hours and 70 percent within 48 hours. These results have been achieved by enabling declaration submission prior to arrival, digitizing declaration processing, increasing Customs operating hours to 24/7, reducing the level of manual inspection through enhanced risk management, and enhancing the collaboration and integration among all government institutions involved in the import/export process.

KSA is rapidly modernizing its airports and expanding its air cargo facilities to eliminate infrastructure bottlenecks. The objective is to increase total air cargo capacity in the Kingdom from 0.8 million tons/year today to 6 million tons/year in 2030.

Technology is improving the security, transparency, and control over the import-export process in KSA. Today, importers track the status and progress of their shipments in real time. Customs brokers receive automated notifications on their mobiles about the status of their shipments and are prompted to create their declarations as soon as the shipping manifest is available online, i.e., prior to ship arrival. KSA recently launched a port community system to guarantee secure and efficient exchange of information among all parties involved in the import/export process, covering vessel operations, terminal operations, digital payment and truck management, among other aspects. A similar community system is now being developed for the airports.

The 3PL segment of the logistics market is expected to grow at 22 percent CAGR until 2020 to reach a value of USD 2.2 billion. Consequently, the warehousing market is expected to further grow at 9% CAGR to reach a market size of USD 4.2 billion by 2020. Growth in this segment is expected to materialize because of increasing manufacturing activity, burgeoning international trade, rising domestic consumption and the easing of government regulations.

The cold chain segment of KSA’s logistics market is no different to the other segments in that it has also seen significant growth over recent years. Growth is expected to reach USD 1.64 billion by 2020 because of active participation by the pharmaceutical industry and the increasing demand for fresh/processed fruits, vegetables, meat and dairy.

Railways and Metros

The railway sector in the Kingdom of Saudi Arabia has been one of the focus transportation modes since its creation in 1951 and became a key enabler for driving economic development by providing a competitive transportation mode for the mining industry. The railway sector governance is composed of multiple stakeholders, amongst which the main stakeholders are the Ministry of Transport (MoT), the Public Investment Fund (PIF), the Public Transport Authority (PTA), the Saudi Railways Organization (SRO) and the Saudi Railway Company (SAR).

The Ministry of Transport (MoT) is mainly responsible for transport sector strategy, infrastructure and overall sector development while the Public Transport Authority (PTA), is responsible for coordinating the development of public transport services within and between cities in the Kingdom.

SRO is a state-owned public railway entity under the Ministry of Transport (MoT), which currently operates a railway network with a total length of approximately 1,400-km between the city of Dammam in the Eastern Province and the capital in Riyadh.

SAR is a private-sector entity and is owned by the Public Investment Fund (PIF), which was created to develop and operate the 2,750-km North- South Railway (NSR) network, which includes freight and passenger services using international best practices of performance and safety.

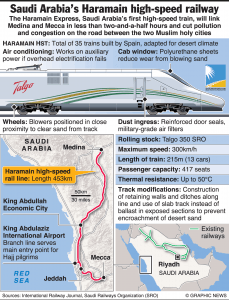

The SAG is currently investing USD 25 billion in three mega projects as part of a combined 3,900-kilometer rail expansion plan. The North-South Rail Project is the largest railway in the region spanning 2,750 km stretching from the capital city of Riyadh (in the northwest of the country) to Al Haditha, near the border with Jordan. The project is costing USD 3.5 billion and is projected to transport four million tons of commodities and two million passengers annually once it is up and running. Two U.S. companies are participating in this project.

The third major rail program is the Saudi Landbridge Project providing the first direct link between the Red Sea and the Arabian Gulf. This proposal includes plans to construct 950 kilometers of new rail line between Riyadh and Jeddah and another 115 kilometers of track between Dammam and Jubail, costing in the region of USD 7 billion. The project will be implemented and operated on build, operate and transfer basis for a period of 50 years. In addition to the above mega-projects, the Saudi government envisions a further 10,000 kilometers of rail and metro tracks to be added to the network by 2030.

The SAG has invested USD 22 billion into a state-of-the-art metro network in Riyadh consisting of six main lines with total track length of 176 kilometers and 85 stations that will connect the city to commercial and retail areas, the financial center, and the airport.

Four metros are planned for Mecca, Jeddah, Madinah and Dammam. All four metro projects will now have a new procurement strategy and the plan is to turn them into PPP/BOT projects. The National Centre for Privatization (NCP) is currently working out the framework for the privatization process and is expected to be ready with the guidelines by the second quarter of 2018. The total cost of the four metro projects is expected to be about USD 55 billion (Mecca Metro about USD 16 billion, Jeddah Metro about USD 12 billion, Dammam Metro about USD 16 billion and Madinah Metro about USD 11 billion. Prequalification is expected to start by the third quarter of 2018. Each project is governed by different entity which will be responsible for tender announcements. Jeddah metro is the responsibility of Metro Jeddah Project company, Madinah Metro is governed by the Madinah Development Authority, Mecca Metro is under Mecca Development Authority and Dammam metro is under Dammam municipality.

Maritime transport

Saudi Arabia’s maritime network is unrivaled in the Middle East, handling a capacity of approximately eight million twenty-foot equivalent containers (TEUs) per year and receiving 11,000 ships annually. The network consists of 10 primary harbors for non-oil trade, 200 piers, 216 berths and six leading container ports located along a critical intersection of the East-West shipping routes. Saudi ports dominate the regional transit market, handling more than 90 percent of Red Sea trade transits and 30 percent of the East African trade transits.

The commercial and industrial ports include Jeddah Islamic Port, King Abdulaziz General Port, King Fahd Industrial Port in Jubail, King Fahd Industrial Port in Yanbu, Jubail Commercial Port, Yanbu Commercial Port, and the ports of Jazan, Dhiba, and Ras Al-Khair. King Abdullah Port, Saudi Arabia’s first port to be fully developed and operated by the private sector, is currently the fastest-growing and most advanced port in the region. In a bid to further take advantage of its location in the region and better serve its local oil-producing industry, Saudi Arabia plans to build a maritime and shipbuilding complex on its east coast to increase its capacity to export oil and eventually have a shipping fleet that will match its oil capabilities.

Efforts are underway to improve seaport efficiency and service quality through increased port specialization, governance reforms, and updated concession frameworks. The recently established port regulator Mawani is leading the efforts for corporatizing and privatizing the port sector. Saudi Arabia is heavily investing in its seaports to modernize its infrastructure and increase their capacity. Several projects worth USD 1.6 billion are already underway and are designed to boost the maritime transport sector by transforming it into one of the most technologically advanced and functional systems of the world. USD8 billion has been set aside by the Saudi Ports Authority as a strategic investment for the equipping and modernization of all of ports.

Land transport

Saudi Arabia has one of the largest road networks in the world covering more than 200,000 kilometers of roads, including 66,000 kilometers of roadways connecting major cities and providing access to railways, ports and airports. This vast and growing ground network benefits from 5,000 kilometers of highways and 6,000 km of bridges, providing extensive means to transport passengers and goods in and around the Kingdom.

Under the current development plan, Saudi Arabia has allocated a substantial sum to the creation and renovation of the Kingdom’s roadways, particularly its heavily used inner-city roads, intersections and bridges. Plans are scheduled to build over 3,500 kilometers of new roads, including 284 highways set to link the country’s main urban centers. Several ambitious projects are starting to take shape, such as the design and construction of Obhur Creek Bridge, located 20 kilometers from Jeddah. Plans for construction include eight lanes of road traffic, footpaths and two lanes of rail transit. KSA road projects are in full swing and are showing no signs of abating with an additional 2,200 kilometers of road construction planned for the next development phase beginning in 2020. Land freight transportation is forecast to boom due to increasing industrial activity and the expansion of e-commerce throughout the region.

Opportunities

- Jeddah Corniche Tram PPP Project: the total length of the tram will be 6 kilometers and it will consist of 11 single cars and 15 stations.

- Obhur Creek Bridge PPP Project: it is 2 kilometers long (360 meters creek crossing), 74 meters wide and 51 meters high. The Bridge will have eight lanes for cars (four in each direction) and will contain Jeddah metro Orange

- Waterbuses & Ferries: MJC is looking to procure 26 waterbuses and planning to build four Ferry

- Jeddah Bus Contract: 1000 buses to be acquired in two phases

- Saudi Landbridge Railway

- Riyadh-Dammam Electrification

- Yanbu-Jeddah Railway

Web Resources

- Ministry of Transport, mot.gov.sa

- Invest Saudi, http://investsaudi.sa/en/

- Saudi Ports Authority, mawani.gov.sa

- General Authority for Civil Aviation, gaca.gov.sa

- Saudi Railways Organization, saudirailways.org

- Metro Jeddah Company, www.metrojeddah.com.sa